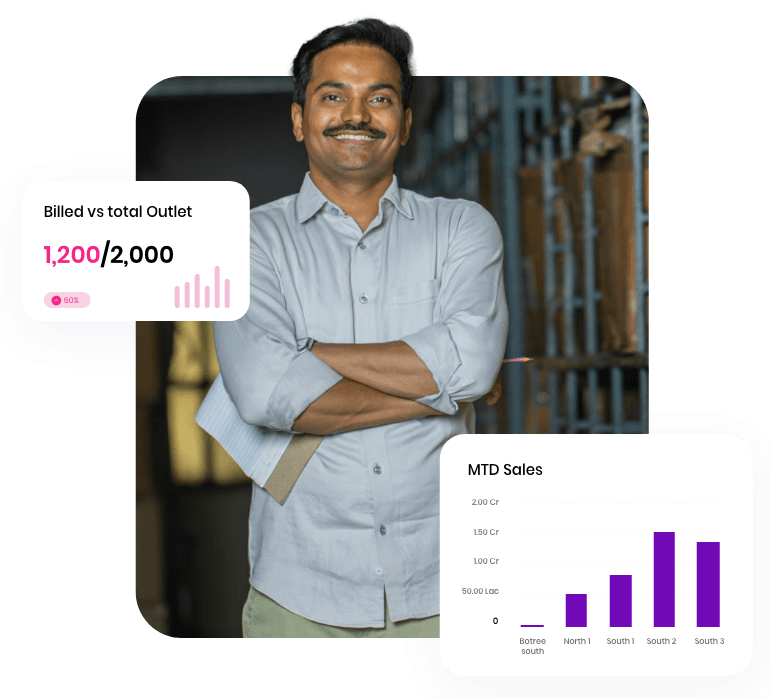

Technology has changed the way brands are improving their presence in the store. Companies traditionally relied on teams and processes to ensure brand adherence and improve presence in the store. Sales and merchandising teams were trained to cover important stores physically and ensure that brands’ presence in the store is maintained. This was methodically captured in reports which have evolved from paper pen reports to electronic forms embedded in apps, PDAs etc.

Basically, the technology advancements (read mobile phones and cameras) were introduced to improve the efficiency of the existing processes. For example, if earlier the process needed the salesperson or merchandizer to give a detailed report on the store, in the new process he/she will need to add a picture to the report.

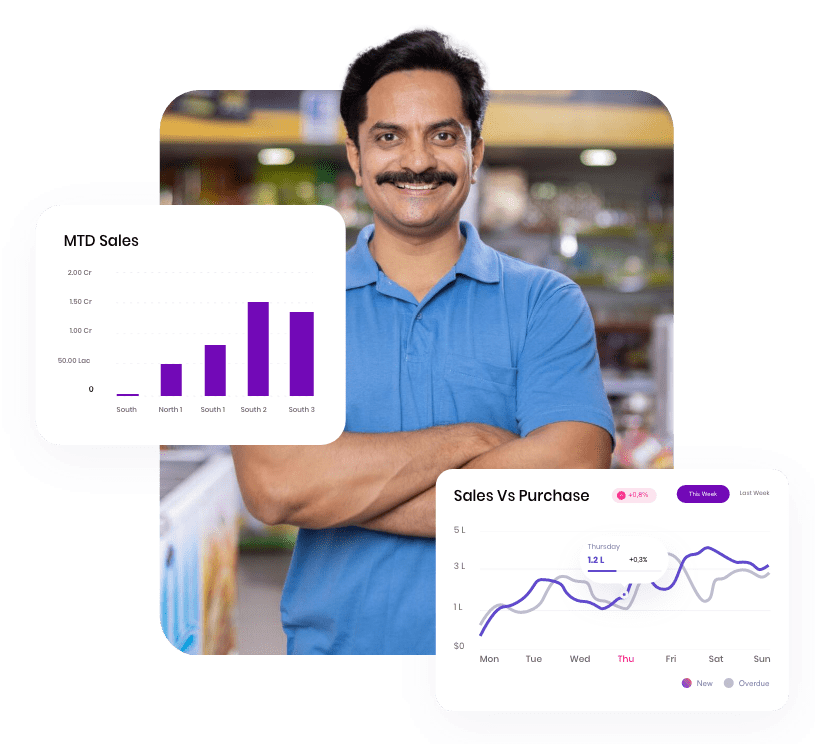

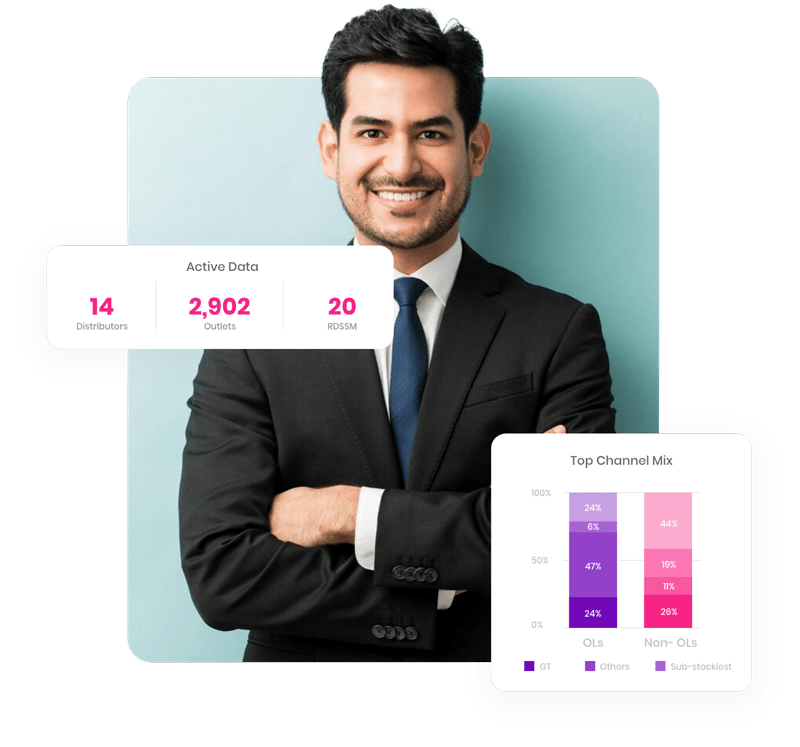

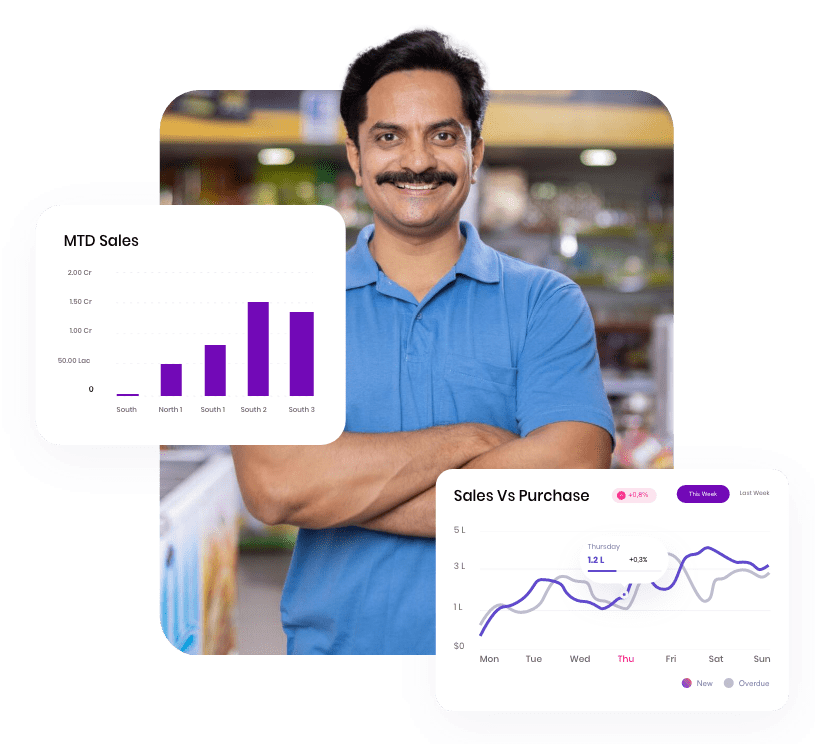

But in the last few years, new processes, and new ideas have started emerging which were not possible in the previous disconnected retail universe. While advancement in SFA solutions and Distribution management solutions were helping the companies to increase their reach, the digitization of stores and the ability to work with the fragmented retail universe has enabled them to drive their growth inside the store.

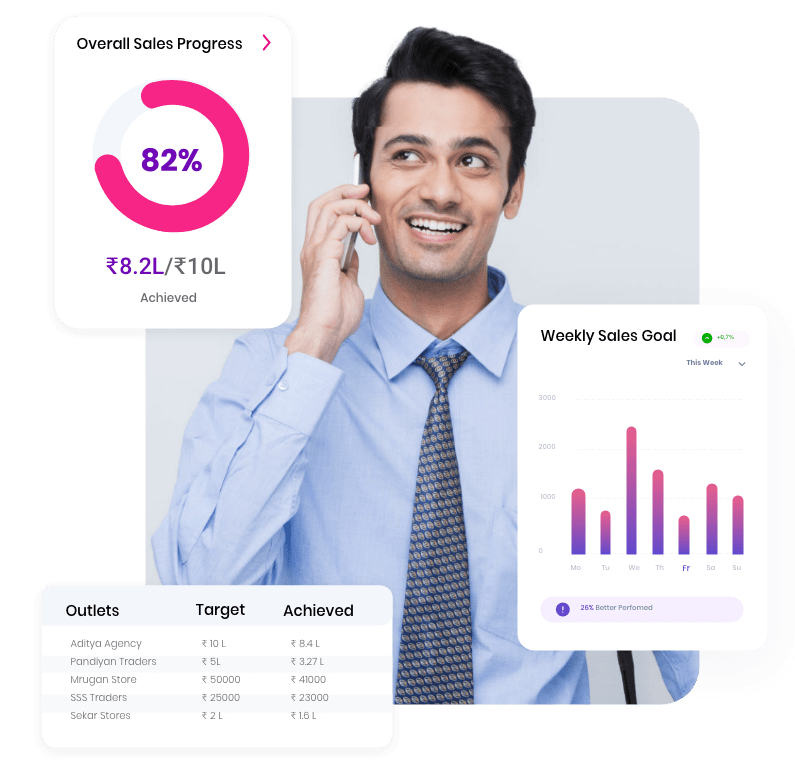

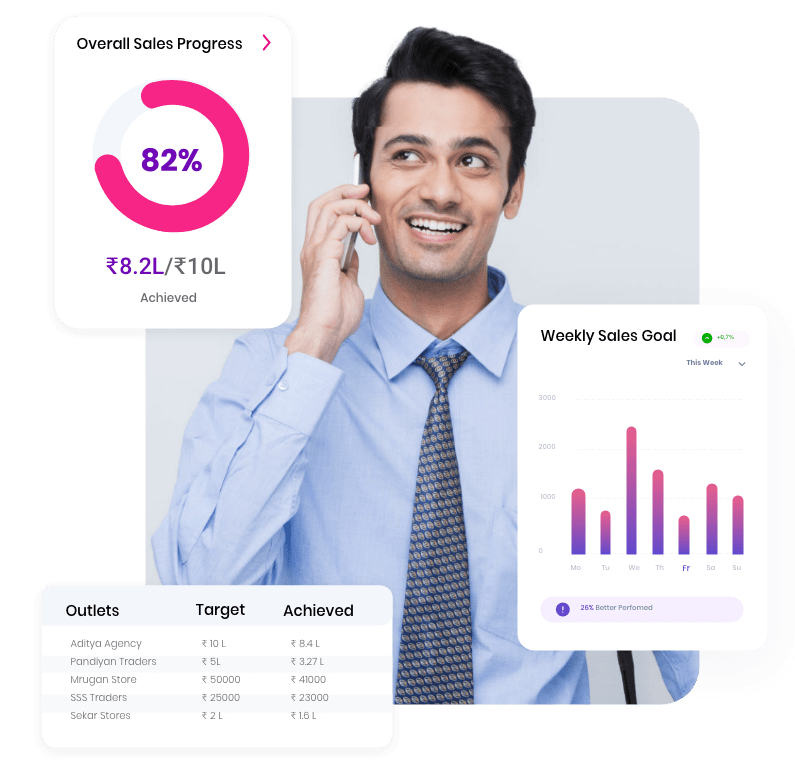

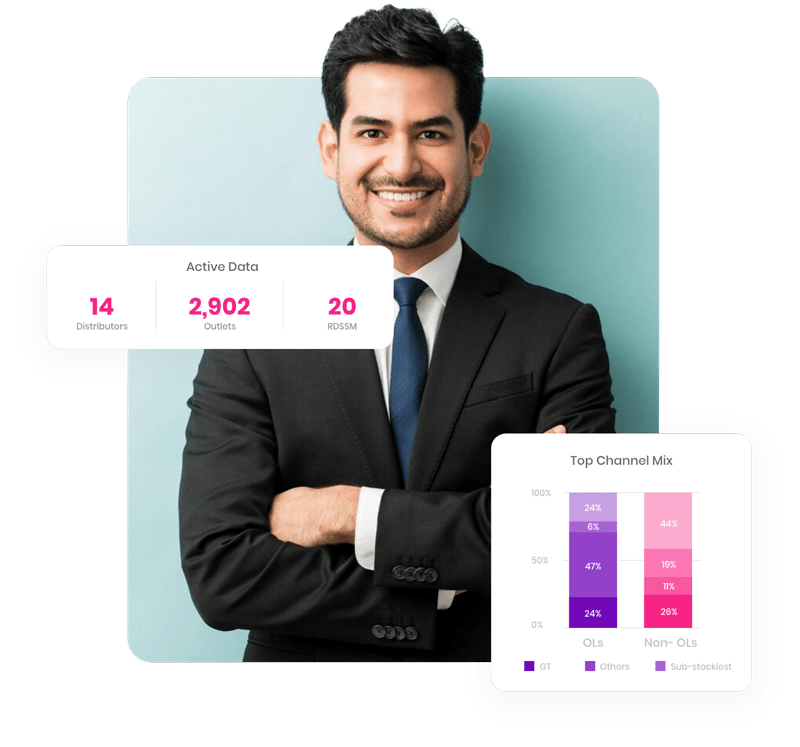

This may feel like old wine in a new bottle, but the ability to know the nature of the store, the categories it sells, the market share of brands and the velocity and volume of its business allows businesses to create profiles which are far more effective than before. Companies can look at the market data and not just their own sales data to enrich these profiles and prevent blind spots. Not only do these profiles help companies know about the shopper at the store, but it also allows them to build targeted schemes to promote their business strategy.

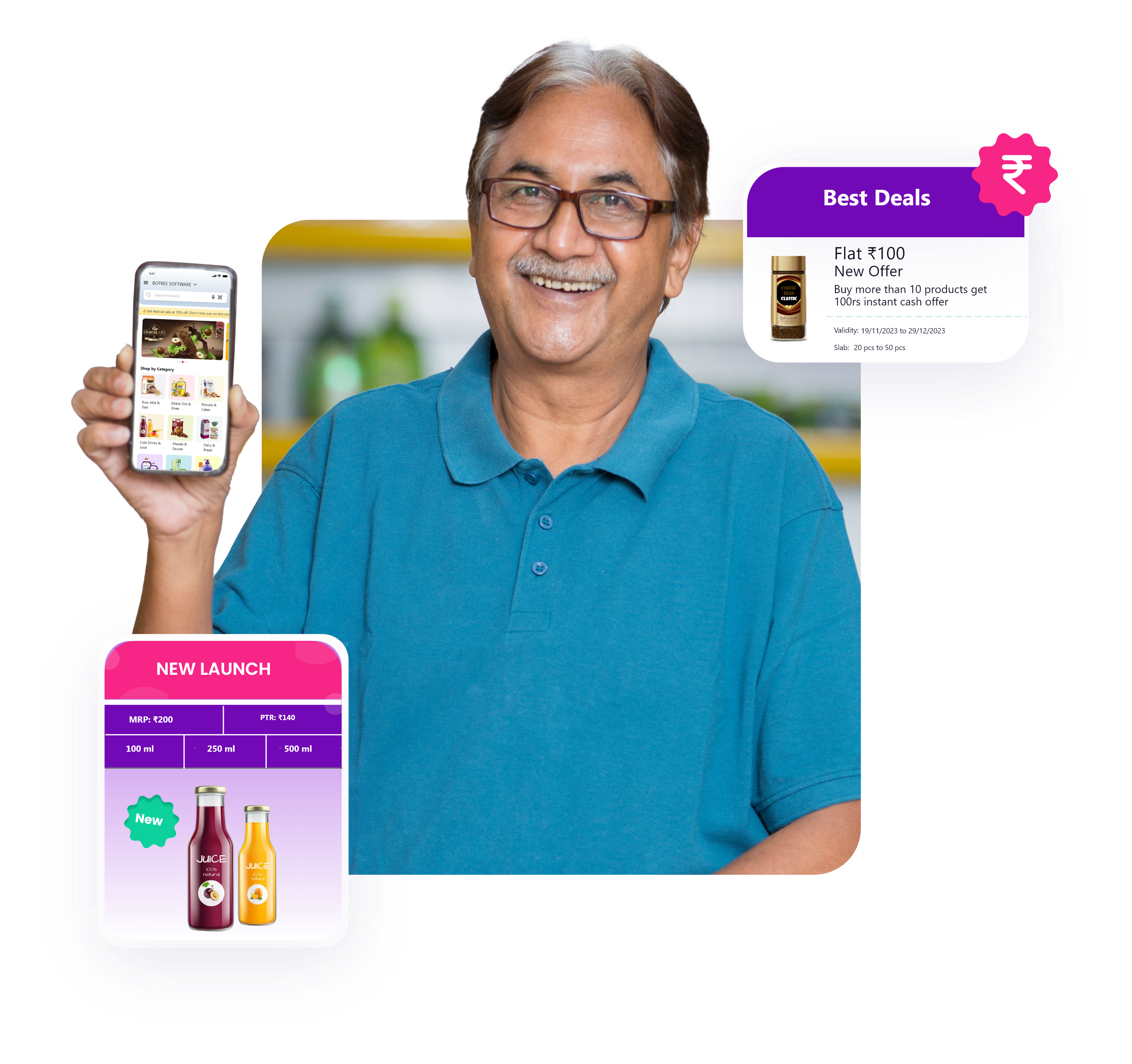

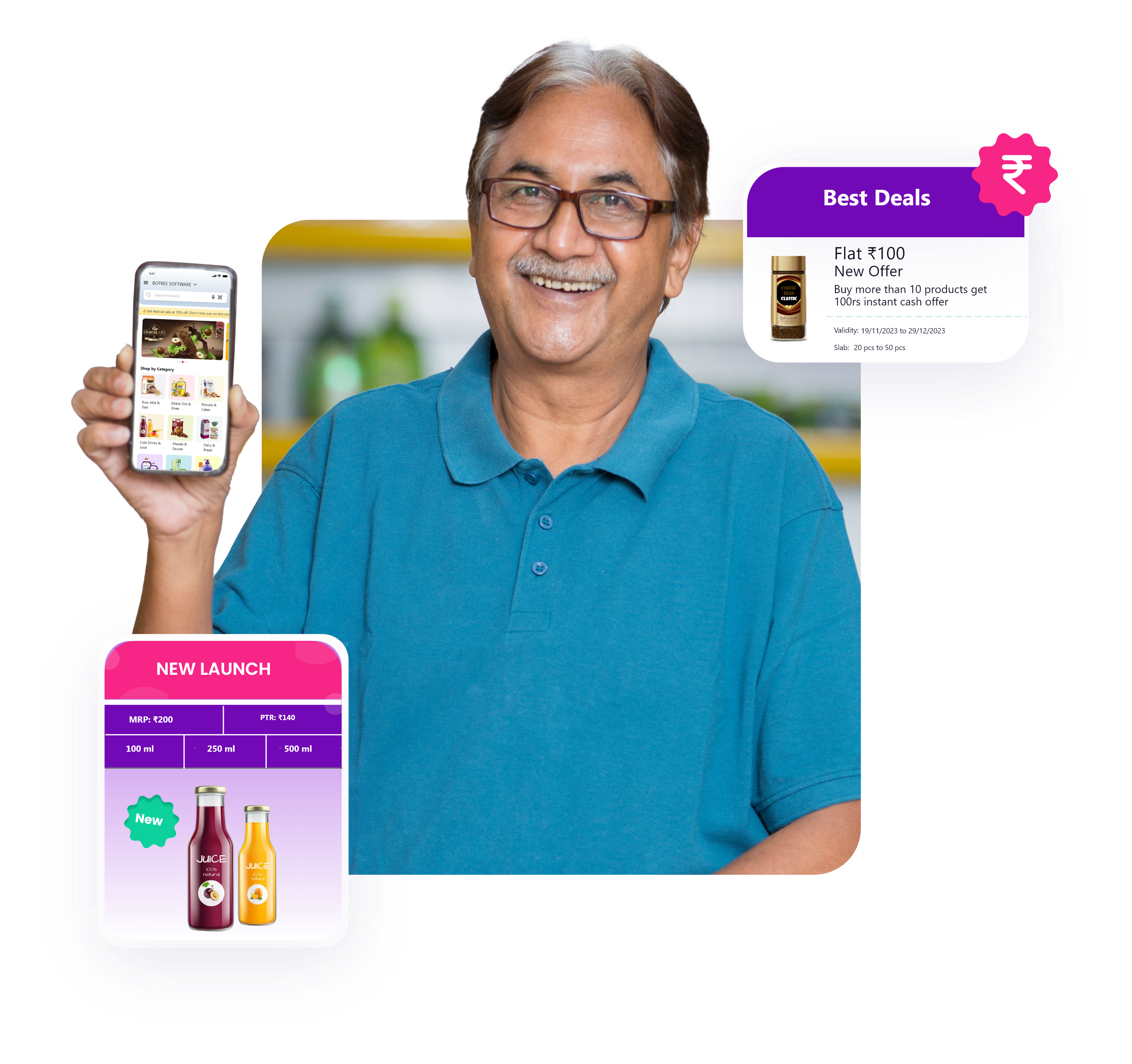

Store profiling is based on the ability to connect with the store directly. This means, that companies can now build schemes not just for the store but for the shopper at the store itself. So, taking it a step further, companies are now running activation at their strategy stores by activating the schemes at the bill level. This targeted approach allows companies to influence shopper behaviour at a micro level.

The other piece of activation is loyalty, and multi-brand companies are now running loyalty at their strategy stores for cross-selling their products. These connections with the shopper at the micro level allow companies to have a pulse on the market which is extremely beneficial at the time of a new product launch or to gain/ring fence market share.

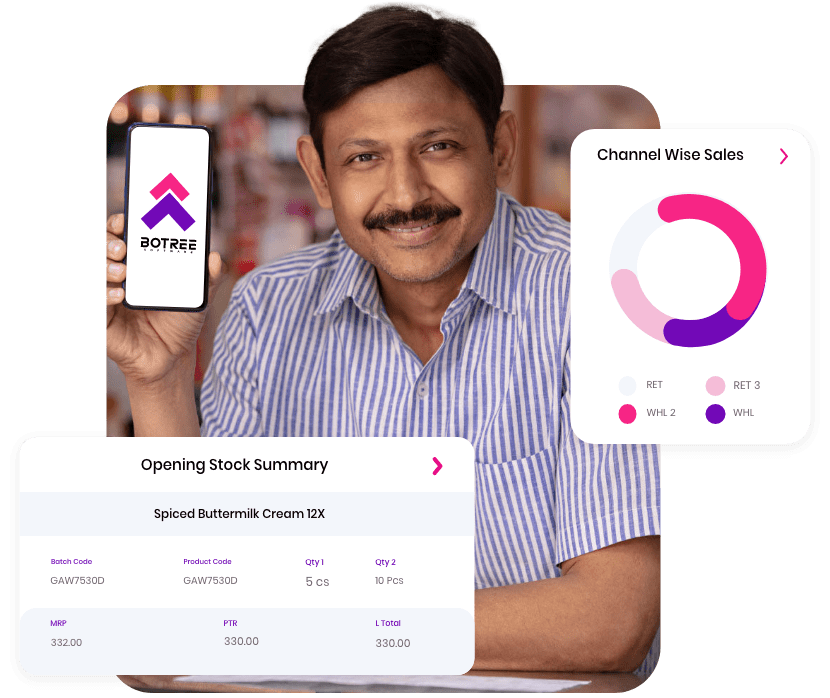

Brand assets at the stores are a major investment by the brand to ensure visibility and presence. Modern-day SFA applications allow the companies to monitor these assets with visual analytics which can help them drive adherence at scale.

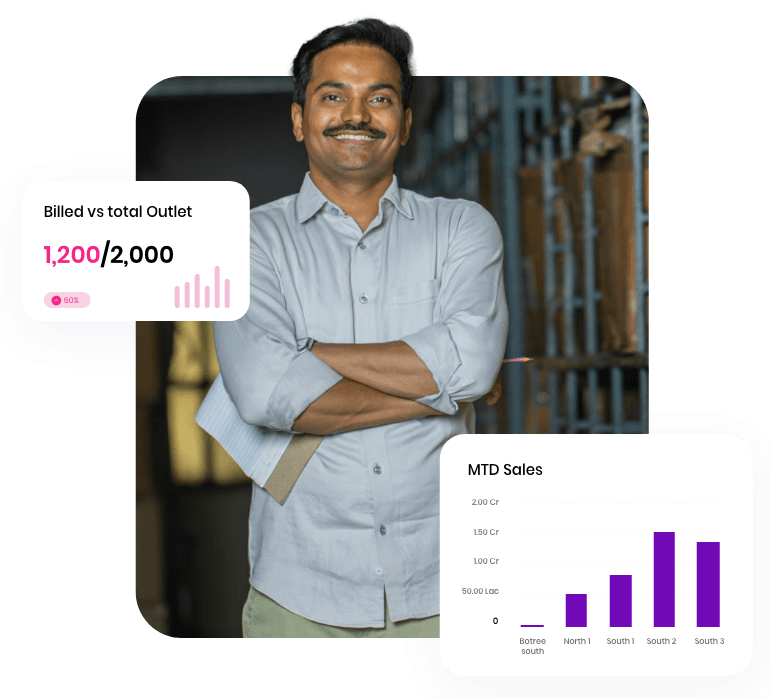

One of the biggest issues faced by multi-brand companies is to maintain an assortment sales strategy at the store level. With the help of secondary sales data, and the tertiary market offtake data outlet cohorts are created for stores with a similar profile. SFA applications are fed Suggested Order Quantity and Must-Sell SKUs list at the store level to drive the salesperson behaviour at the store. These suggestions are built using predictive algorithms to create a scenario which would maximise the business benefit for the company.

Companies have become ultra-focused on surveys. By running these surveys at the store level with the SFA applications, companies can track strategy execution and know the other softer aspect of the market. Thus, the nature of these surveys is changing from getting market data to say track business to getting feedback data to add as a data stream to the insights engine which already has access to tertiary and secondary offtake data. E.g. the companies do not use surveys to track new entrants but to know how the store owners and shoppers are responding to the new entrant.

In a crowded market, it’s very difficult for manufacturers to catch the customer’s eye and retail store’s shelves. Getting a customer to pick your product over another similar or competing product is a constant challenge. Retailers also prefer to stock products that they are sure will be fast-moving and will generate constant revenue. Thus, companies need to constantly improve their presence in stores. The in-store expansion has been at the forefront of innovation in the retail technology ecosystem in the market. With the increase in adoption, these solutions will become more effective and justify investment at scale.

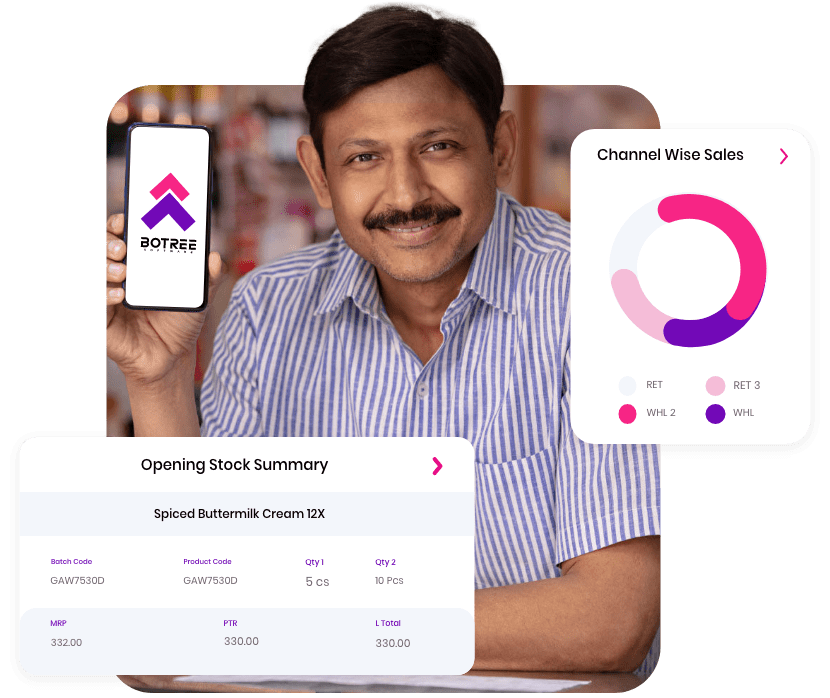

Botree Software’s extensive solutions for retail stores with the RS Market(i) platform can help store owners leverage technology and data to help modernise their stores and increase revenue. Get in touch, to learn more about our Store Connect, and Shopper Connect solutions and RS Market(I) platform to help you modernise your store.